Financing Our Future

Kurzinformation

inkl. MwSt. Versandinformationen

Artikel zZt. nicht lieferbar

Artikel zZt. nicht lieferbar

Beschreibung

The monetary system is the indispensable missing link in the debate of sustainability, and whether the current financial system can handle these evolved needs. To date, the UN Sustainable Development Goals (SDGs) primarily have been financed either through the private sector, through conventional public sector taxes and fees, or through philanthropic commitment. Assuming a need of 4 to 5 trillion dollars annually in the 10 to 15 years left to finance our future, these conventional sources of finance are insufficient in terms of both the scale and speed of funding required to finance our future. Furthermore, the inherent instability of our financial system forces the world community to focus first and foremost on repairing and stabilizing the existing system.The development of cryptocurrencies using distributed ledger technologies (mainly blockchain) has prompted leading central banks to study the potential application of this approach to independently create purchasing power. In this vein, this book offers a new approach, namely introducing a parallel electronic currency specifically designed to finance global common goods and provide the resources necessary to achieve the SDGs. Furthermore, this mechanism would have a stabilizing effect on the existing monetary system.The book argues that one way this could be achieved is by giving central banks a modified monetary mandate to inject new liquidity into the system using a top-down approach. Alternatively, liquidity could come from corporate or communal initiatives with crypto- or communal currencies in a bottom-up approach. The author maintains that by issuing a blockchain-enabled parallel electronic currency earmarked for SDG-related projects and using other channels for monetary flow rather than the conventional ones, the future could be financed in a different manner. In the long run, abandoning our current monetary monoculture and introducing a monetary ecosystem would stabilize international financial markets, increase monetary regulatory efforts, reduce negative externalities, create a social Pareto optimum and stabilize democracies. This book presents, in the same spirit as Fritjof Capra's The Tao of Physics, a Tao of finance-an outside-of-the-box approach to financing global common goods. von Brunnhuber, Stefan

Produktdetails

So garantieren wir Dir zu jeder Zeit Premiumqualität.

Über den Autor

Stefan Brunnhuber is currently an Endowed Professor for Psychology & Sustainability; as a MD psychiatrist he is Medical Director and Chief Medical Officer at Diakonie Kliniken, acute Hospital for Integral Psychiatry in Germany. He has more than 25 years of experience in research, business, finance, psychology and sustainability and continues to work as an institutional and corporate consultant. He holds PhDs in both medicine and socio-economics from the University of Konstanz und Würzburg, Germany. As Full Member of the Club of Rome and Trustee of the World Academy of Art and Science, he has been involved in the field of finance and sustainability over two decades.

- Taschenbuch

- 475 Seiten

- Erschienen 2014

- UTB GmbH

- paperback

- 496 Seiten

- Erschienen 2001

- Erich Schmidt Verlag

- hardcover

- 364 Seiten

- Erschienen 1988

- Pearson

- Hardcover -

- Erschienen 2009

- Vahlen

- Gebunden

- 596 Seiten

- Erschienen 2023

- Vahlen

- Hardcover

- 200 Seiten

- Erschienen 2019

- Kogan Page

- Kartoniert

- 248 Seiten

- Erschienen 2023

- Springer Gabler

- Gebundene Ausgabe

- 354 Seiten

- Erschienen 2020

- Logos Berlin

- Hardcover

- 320 Seiten

- Erschienen 2016

- Wiley

- Gebunden

- 238 Seiten

- Erschienen 2007

- Gabler Verlag

- Kartoniert

- 400 Seiten

- Erschienen 2021

- Wiley-VCH

- Gebunden

- 368 Seiten

- Erschienen 2019

- PublicAffairs

- Kartoniert

- 448 Seiten

- Erschienen 2017

- Wiley-VCH

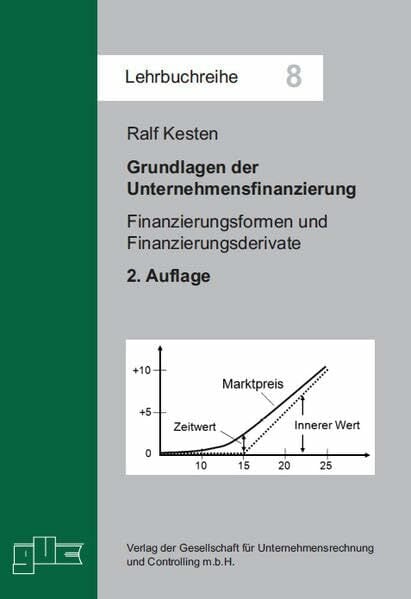

- Kartoniert

- 624 Seiten

- Erschienen 2017

- NWB Verlag