XVA

Kurzinformation

inkl. MwSt. Versandinformationen

Artikel zZt. nicht lieferbar

Artikel zZt. nicht lieferbar

Beschreibung

Thorough, accessible coverage of the key issues in XVA XVA - Credit, Funding and Capital Valuation Adjustments provides specialists and non-specialists alike with an up-to-date and comprehensive treatment of Credit, Debit, Funding, Capital and Margin Valuation Adjustment (CVA, DVA, FVA, KVA and MVA), including modelling frameworks as well as broader IT engineering challenges. Written by an industry expert, this book navigates you through the complexities of XVA, discussing in detail the very latest developments in valuation adjustments including the impact of regulatory capital and margin requirements arising from CCPs and bilateral initial margin. The book presents a unified approach to modelling valuation adjustments including credit risk, funding and regulatory effects. The practical implementation of XVA models using Monte Carlo techniques is also central to the book. You'll also find thorough coverage of how XVA sensitivities can be accurately measured, the technological challenges presented by XVA, the use of grid computing on CPU and GPU platforms, the management of data, and how the regulatory framework introduced under Basel III presents massive implications for the finance industry. * Explores how XVA models have developed in the aftermath of the credit crisis * The only text to focus on the XVA adjustments rather than the broader topic of counterparty risk. * Covers regulatory change since the credit crisis including Basel III and the impact regulation has had on the pricing of derivatives. * Covers the very latest valuation adjustments, KVA and MVA. * The author is a regular speaker and trainer at industry events, including WBS training, Marcus Evans, ICBI, Infoline and RISK If you're a quantitative analyst, trader, banking manager, risk manager, finance and audit professional, academic or student looking to expand your knowledge of XVA, this book has you covered. von Green, Andrew

Produktdetails

So garantieren wir Dir zu jeder Zeit Premiumqualität.

Über den Autor

- Kartoniert

- 600 Seiten

- Erschienen 2021

- Hirnkost

- hardcover

- 408 Seiten

- Erschienen 2014

- Tor Books

- Gebunden

- 480 Seiten

- Erschienen 2019

- Loewe

- Kartoniert

- 192 Seiten

- Erschienen 2009

- Carlsen Manga

- hardcover

- 302 Seiten

- Erschienen 1994

- Rizzoli

- hardcover

- 468 Seiten

- Erschienen 2013

- Sourcebooks Fire

- Hardcover

- 356 Seiten

- Erschienen 2021

- Bookouture

- hardcover

- 464 Seiten

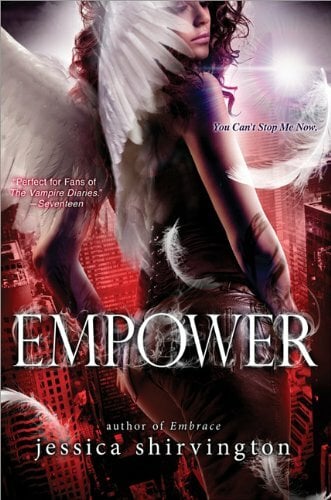

- Erschienen 2013

- Sourcebooks Inc

- perfect

- 614 Seiten

- Erschienen 2024

- Habitat Verlag

- hardcover

- 496 Seiten

- Erschienen 2014

- Sourcebooks Inc

- paperback

- 406 Seiten

- Erschienen 2010

- Pinnacle Books